SUPERAGENT AI CEO Vlada Lotkina and CTO Vadym Shashkov issue a final warning to the industry: automate retention today or face obsolescence when the fully autonomous agent arrives in Q1 2026.

The new Retention AI Agent automates the lifecycle, issuing a stark warning: adopt now or face obsolescence when the Fully Autonomous Agent arrives in Q1 2026.

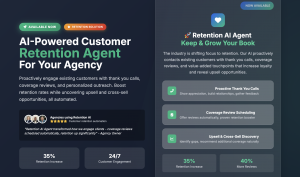

MIAMI, FL, UNITED STATES, December 2, 2025 /EINPresswire.com/ -- SUPERAGENT AI, Inc. today announced the launch of the Retention AI Agent, a breakthrough system that fully automates client retention, coverage

reviews, and cross-selling. But the announcement comes with a warning: The window for agencies to adapt to the age of AI is closing.By automating the final piece of the client lifecycle, retention and growth, SUPERAGENT AI has laid the groundwork for its ultimate vision. The company confirmed today that it is on schedule to release the Quoting AI Agent very soon, which will serve as the final "missing piece" before the deployment of the industry’s first Fully Autonomous Insurance AI Agent in Q1 2026.

"Let’s be brutally honest: if your agency is still relying on humans for scheduling coverage reviews or to build the customer relationships you need to build, you are just wasting time and money," said Vlada Lotkina, CEO of SUPERAGENT AI. "The Retention AI Agent we are launching today isn't just a new feature; it is the end of manual account management. We are moving at a breakneck speed, innovating month-over-month. Agencies that don't start integrating this infrastructure now will be completely unprepared when we flip the switch on full in Q1 2026, there will be two types of agencies: those powered by SUPERAGENT AI, and those that are playing catch up all year."

The End of "Silent Churn" The Retention AI Agent tackles the industry's silent killer: neglect. For the first time, agencies can deploy a digital workforce that proactively manages the entire book of business without human intervention.

- Automated Coverage Reviews: The AI systematically contacts every client to schedule coverage reviews, a proven retention driver that most agencies simply "don't have time for."

- Upsell & Cross-Sell Discovery: It doesn't just check in; it identifies revenue gaps. The AI detects life changes (like a new teen driver or home renovation) and naturally pivots to cross-sell opportunities, flagging them for the producer.

- Relationship Building on Autopilot: From "thank you" calls to satisfaction checks, the agent ensures no client ever feels ignored.

The Roadmap to Autonomy SUPERAGENT AI’s aggressive release schedule is designed to force the industry forward. With the Training, Live Coach, Live Call, and now Retention AI Agents live, the platform covers 90% of an agency's workflow.

Coming Very Soon: The Quoting AI Agent, which will automate the complex process of carrier rating and proposal generation.

Q1 2026: The launch of the Fully Autonomous Insurance AI Agent, a unified digital employee capable of handling the entire lifecycle, prospecting, selling, binding, service, and retention, independently.

"We aren't building tools for the status quo; we are building the replacement for the old way of doing business," said Vadym Shashkov, CTO of SUPERAGENT AI. "The technology is proven. The track record is undeniable. We are giving agency owners the Q4 ramp-up period to get their data and workflows AI-ready."

Availability: The Retention AI Agent is available immediately. Agencies are urged to deploy the system today to prepare their infrastructure for the autonomous revolution of 2026.

About SUPERAGENT AI: SUPERAGENT AI is building the autonomous workforce for the insurance industry. Its platform of specialized AI agents handles the complete lifecycle of insurance sales and service. The company is on a mission to deliver a fully autonomous AI insurance agent by 2026, empowering agencies to achieve unprecedented growth and efficiency.

No comments:

Post a Comment